Sick pay leaves are the advantages to the workers by the employer. The leave is allowed employees to remain home due to health considerations from which some are with or without pay. Now the employer can prohibit the utmost leaves taken at a time in order that the sick pay could be carried over. The set-up sick pay in QuickBooks feature comes in the replace of QuickBooks Desktop 2019 R3. The leaves are additionally proven in the employee’s pay stub for simply seen to you.

Also be certain to review our support hours for when representatives shall be out there. I Am Going To do no matter it takes to ensure your concerns are addressed. Thank you in your persistence, If you’ve another questions or issues, be happy to publish them here. This article highlights the method to examine when you have probably the most current version of Desktop and how to manually replace it should you want too.

Rates for workers’ compensation insurance coverage are decided by the region of the nation, the business, and the employer’s own history of office accidents. At this time, modifications are coming every day to QuickBooks payroll products. Caution, as that is nonetheless being sorted out, you can not use PPP loan or EIDL mortgage to pay the sick pay, you must have another supply of funding, provable, I suppose, by financial institution assertion. Based on the tax monitoring, whatever is the tax tracking set for the merchandise will have an effect on the 941 types. An eligible employer must carry on a commerce or business throughout calendar yr 2020 or 2021 and meet considered one of two requirements.

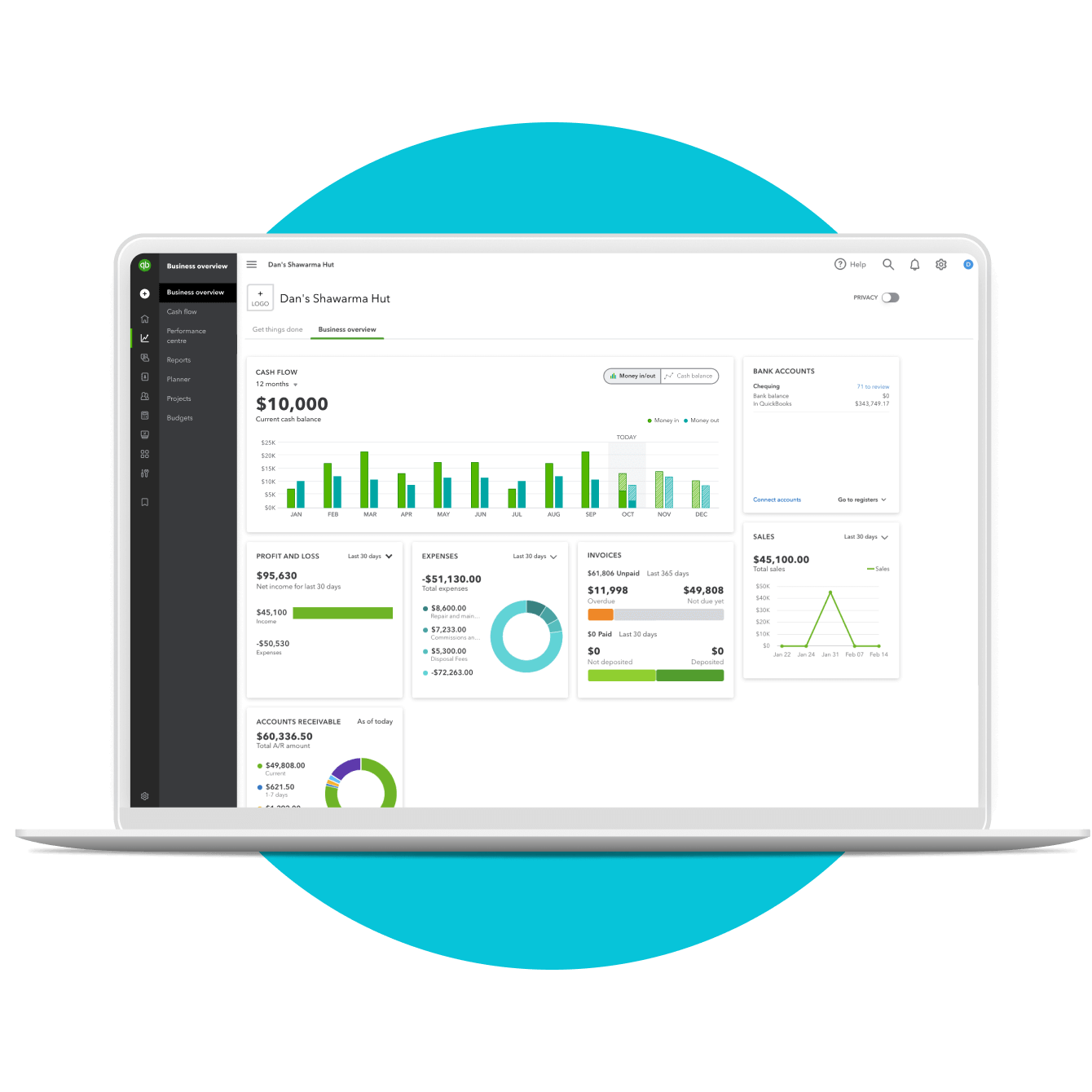

The 2/3 pay relevant go away is 2/3 of regular rate over a 40 hour week. For a salaried place, one could cut back their wage by 1/3 for the period(s) as an alternative of x time y however the max per day nonetheless has to be adhered to. During this time, running your small business could be complicated with how you need to arrange your Payroll. Rest assured, changes are coming daily to QuickBooks Payroll merchandise. Our Payroll Groups here at Intuit are working rapidly to create appropriate Pay Types, that means you can monitor and report hours in the direction of this Tax Credit for your small business.

Really Feel welcome to message me anytime if you nonetheless have questions or issues. Like FUTA, state unemployment tax, or SUTA, can also be paid by employers. Most states also require employers to pay into a workers’ compensation insurance coverage fund.

Crucial Accounting Software Program Errors

In the Default Price and Limit window, make sure the speed is at zero and the restrict is at $10,000, choose One Time Limit from the Restrict Kind drop-down, and choose Finish. In most circumstances, you’ll pay your worker the hourly rate you’ve paid them during the last 6 months. Nevertheless, there are a couple of https://www.quickbooks-payroll.org/ exceptions that correspond with the Regular Fee of Pay Beneath the Truthful Labor Requirements Act (FLSA). For extra information on small business employment, read our article on all the costs that go into paying an employee.

- Underneath FFCRA, there are three various varieties of paid go away.

- If you need help with claiming your tax credit, click this hyperlink to for the step-by-step instruction.

- As the COVID-19 state of affairs continues to evolve, the stipulations for an worker taking paid depart may change.

- Really Feel welcome to message me anytime should you nonetheless have questions or concerns.

- Most payroll providers supply a trimmed-down answer for small enterprise house owners who might not want as many options as bigger corporations.

- Be sure to review their help hours so you will know when brokers are available.

Moreover, the ERC is out there through December 31, 2021. There isn’t any cap on the whole quantity of ERC obtainable for a single employer. After setting up an expense & liability account, the next thing is to set up the payroll gadgets so as to track the paid depart sort. Yes, QuickBooks Online Payroll and QuickBooks Desktop Payroll have features to help calculate relevant tax credit for COVID-related payroll items, provided they are accurately arrange. The Internal Income Code defines wages as payment for employment, including taxable benefits.

The employer can select which wages are used to support PPP mortgage forgiveness and which are used for the ERC. Ensure that you embed the appropriate payroll gadgets for depart. Let me share some information about how paid go away and sick time are tracked in QuickBooks. There are some kinds of wages, fringe advantages, and different remuneration that you don’t need to pay Social Safety or Medicare taxes on.

Employee Retention Credit: Key Benefit For Small Enterprise Homeowners Under The Cares Act

As an employer, your responsibility is to accurately calculate the quantity of gross wages which might be eligible for federal and state taxes, as well as the following tax amount. Once you’ve deducted that amount, it’s your duty to move that money alongside to the appropriate government company. Your employees’ wages determine the ultimate quantity you, as a enterprise, pays. Begin by deducting the applicable percentages — 6.2% for Social Safety and 1.45% for Medicare — from the employee’s gross wages.

Don’t be late with payments, as you may be slapped with a penalty of up to 15% of the missed quantity. Primarily Based off of How to Observe Paid Go Away and Sick Time for the Coronoavirus, this is applicable to a lot of your present workers. You can use the above article as a information and reference to tracking your staff during this time.

Generally, the widespread wage structures are annual salary or hourly workers quickbooks qsehra. There can additionally be the possibility of a base wage, plus fee, notably in gross sales. The second factor that goes into payroll is deducting the right amount of an employee’s wages to satisfy his or her annual earnings tax. This is known from a small enterprise owner’s perspective as an employee’s earnings tax deduction.

+1-888-843-5849

+1-888-843-5849